notify ato moving overseas - access mygov overseas : 2024-11-02 notify ato moving overseas As I understand it I must notify the ATO when I move overseas via a form that should be accessible on the Tax module within MyGov. This is not the case so I .

notify ato moving overseas2015. Payout %: 98.32% E-mail:

[email protected]. 96% Rated. Graphics - 96% Gameplay - 94% Bonuses - 95% Value - 99% Whizz hot? Accepts Bitcoin. Robust collage of Rival games. Near-instant cashouts for BTC. .

Tested according to AOAC efficacy standards for non-food contact surface sanitizers on hard nonporous surfaces. OdoBan® can help reduce cross-contamination when used as a sanitizer on non-food contact surfaces in restaurants, kitchens, canteens and food processing facilities.

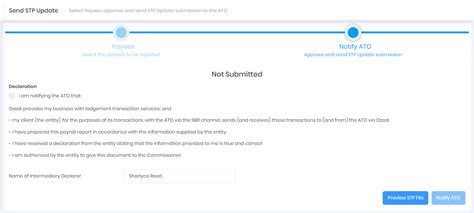

notify ato moving overseasTo notify us, complete an overseas travel notification and update your contact .If you're leaving Australia to live overseas, find out about the tax-free threshold and .If you're leaving Australia to live overseas, find out about the tax-free threshold and how it applies to you. Certificate of residency and overseas tax relief form Request a certificate . As I understand it I must notify the ATO when I move overseas via a form that should be accessible on the Tax module within MyGov. This is not the case so I . To notify us, complete an overseas travel notification and update your contact details, including your mobile, international residential, postal and email . When you move overseas you can let us know your residency status has changed by submitting a tax return. You can submit an early tax return if you meet some .There's no need to notify us that you're moving! You might still have some tax obligations here though, depending on your circumstances. We have information on our website .

What to do before you travel or move overseas. How your plans may affect your payments, concession cards, health care and child support.Steps to Notify the ATO. Determine your tax residency and be clear on your tax obligations. Submit the tax return in the year when you left and update ATO on the date . Hey, I've been living overseas since 2012 and am now trying to declare my worldwide income for the 2016/17 tax year, in line with the new HECS repayment rules. However, in myGov, I can only see the option to submit an overseas travel notification for upcoming or recent departures from Australia. MyGov and the overseas travel .

notify ato moving overseasI recieve the Australian Aged Pension and moving to UK permantly. I dont wont to be taxed twice. I would like to be taxed on all my Australian and UK pensions and bank accounts only in the UK as a British Citizen. How do I notify Australia ATO not to tax me as a non resident, on my Australian Pension. Also how do i go about notify ATO that I will be tax .

I'm a financial adviser. Trace a pre-1998 policy. Product not listed? Looking for fund information? If you are an existing investment customer we can help you with: Flexible Guarantee Bond, Heritage Policies, RNPFN, Tracing a pre-1998 policy and much more. Explore how we can help you here.

notify ato moving overseas